Budgeting Project

Budgeting may seem simple once you've done it. Keep the goal in mind to make it useful.

The Goal

The goal is to help you answer the following questions:

- How much can I blow on restaurants, movies, rock n' roll concerts, cocaine, etc. every month?

- In other words, what's my Disposable Income?

- How much do I spend every month?

- Where can I cut costs?

Setup

Enough bullshit. Let's make a budget. This is the same excel file that I use for my budget.

Open up the example budget so you can reference it as you need.

Make a copy of the the blank budget for your type of paycheck.

- If you get paid twice a month, open the "Blank Budget - Semi-Monthly".

- If you get paid every two weeks, open the "Blank Budget - Biweekly"

- Blank Budget - Semi-Monthly.

- Blank Budget - Biweekly.

You'll be filling out the "Per paycheck" column through each phase.

Do not copy and paste from the example budget. I want you typing out the numbers in the blank budget cells by hand.

Phase 1: Revenue

Fill in the "Revenue" row in the "Per Paycheck" column with the amount of money you get every paycheck.

Where do you find your paycheck/paystub? You should get something from work that says how much you made and how much was deducted in taxes.

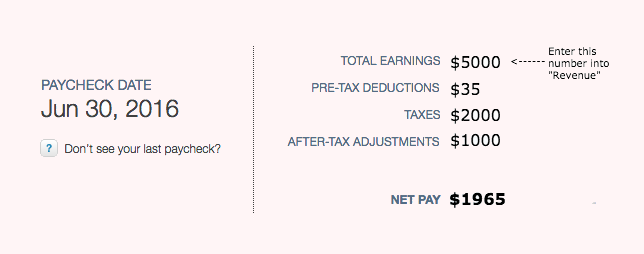

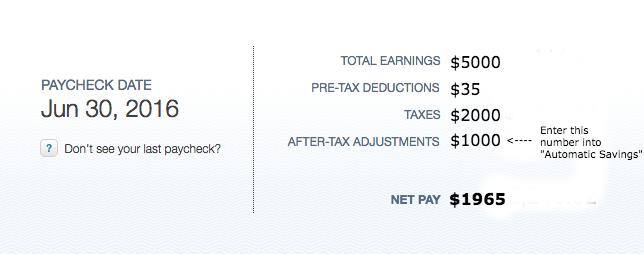

Here's what mine looks like:

(Numbers changed to protect the innocent.)

Often, your paycheck is emailed or physically mailed to you. Mine is on a website (https://paychecks.intuit.com). Email your boss/manager or HR person at work if you can't find it.

If you can't find a paycheck or pay stub, you can guesstimate the numbers for now.

Note: You should fill in Revenue with the amount you make before taxes or savings. Don't worry, we'll deal with that stuff next.

In my example budget, I've filled in my "Revenue" column with $5000, the first line on my paycheck before I subtract anything.

Phase 2: Taxes

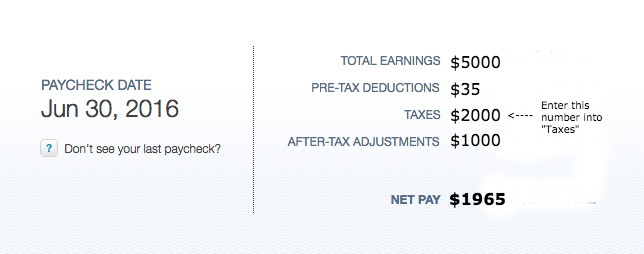

Fill in the "Taxes" row in the "Per Paycheck" column with the amount of taxes you pay (i.e., the taxes that are withheld from) every paycheck.

If you have pre-tax deductions, don't worry about them for now. We'll hit them later.

Note: Make sure you enter a negative number, which says that you're paying money for taxes.

Phase 3: Savings

Fill in the "Savings" row in the "Per Paycheck" column with the amount of money you want to save every paycheck through your company.

This will usually be money you save through a company 401K plan and it will appear on your pay stub. This is also extra money you choose to save on your own from your bank account.

How much should you save? Save 20% of your pre-tax pay as a very rough rule of thumb. The percentage that you save ends up being crucial in the long run. I'll go into more detail about how much to save and how to save in the Saving lesson.

In my example pay stub, my automatic 401K savings live in "after-tax adjustments".

To nitpickers (beginners, you can skip this): yes, sometimes you deduct savings before taxes (e.g., with a traditional 401K). I care about the cash you're actually paying right now. If you ever pull money out of your retirement fund in the future, you'll be changing the income and taxes rows of your budget to account for the money you pull out.

Note: Make sure you enter a negative number, which says that you're paying money out for savings. You'll be getting this money back in the Revenue row later in life.

Phase 4: Charity

Fill in the "Charity" row in the "Per Paycheck" column with the amount of money you expect to donate to charity per paycheck.

An easy way to do this: take the amount of money you want to give each year.

- If you get paid biweekly, divide by 26 (52 weeks a year and you're paid once every two weeks).

- If you get paid twice a month, divide by 24 (12 months a year, twice a month).

For example:

Jade wants to donate 10% of her after-tax salary

Jade makes 100K after taxes

Jade makes 8.3K per month (divide by 12)

Jade makes 4.16K per paycheck (divide by 2)

Jade donates $416 per paycheck (times 10%, or divide by 10)

This amount is obviously up to you. Some people donate 0% of their after-tax and after-savings pay, some people donate 50% of their pay before taxes. It's up to your personal values here.

Note: Make sure you enter a negative number, which says that you're paying money out for charity.

Phase 5: Rent and Utilities

I lump together rent, water, gas, electric payments, and internet. I can find the amount I pay on monthly bills from my landlord, PG&E, and Comcast. These are usually emailed or mailed to me.

I add $75 per month on top of the expenses I already pay. Choose a number here that's intentionally conservative, expecting that you'll pay extra for various reasons. There might be some small expenses that you forget, or an application fee when you first apply for an apartment. You might turn up the heat in a San Francisco summer and spend more than you thought.

For example:

Monthly Rent: $1825 (ergh. San Francisco.)

Monthly PG&E: $20 (gas and electric, water is free in my building)

Monthly Comcast: $80 (ergh. Comcast.)

Monthly Fudge Factor: $75

Total Rent and Utilities: $2000

Find these numbers now and add them up. They're probably monthly.

- If you get paid biweekly, multiply by 12 (yearly amount) and divide by 26 (paychecks per year).

- If you get paid twice a month, divide by 2.

Fill in the "Rent and Utilities" row in the "Per Paycheck" column with the amount of money you expect to pay for rent and utilities per paycheck.

Rent is an expense that you'll want to avoid as much as possible. People who get wealthy deal with this in creative ways. I know one accountant who lived at home with her parents (and her husband!) after college and she was a millionaire by age 30. A relative of mine lived in an apartment with rats in it for dirt cheap in his 20s. I know a few people living in RVs instead of apartments. Some people find it cheaper to live in Las Vegas and commute by plane.

How much should you spend on rent? For now, as a rough rough rule of thumb, the standard wisdom is that you don't want to spend more than 30% of your income AFTER taxes. That's the first bolded row in your excel file.

How much should you spend on utilities? Somewhere around 2-10% of your after-tax pay. You normally can't control how much you pay for utilities, so you'll usually look other places to cut costs.

Note: Make sure you enter a negative number, which says that you're paying money out for rent.

Phase 6: Food

Fill in the "Food" row in the "Per Paycheck" column with the amount of money you expect to pay for your basic food needs per paycheck.

When I say "basic food needs", I mean the normal meals and snacks that you'd eat throughout the week. You're likely paying money at grocery stores and the sandwich shop near work, and the food bar at Whole Foods if you're a yuppie. Don't include restaurants yet. Restaurants will come from disposable income.

This might be an area you can cut down: some people make lunch at home or cook in bulk; it depends how much you care about your time.

The way I calculate my food cost per paycheck:

$2.15 per breakfast ($1 fruit + .40 milk + .75 cereal - on average)

$7.75 per lunch (two $6 footlong subs per meal * 3 times a week because we get lunch catered at work twice a week, + about $1 worth of snacks 2 days a week to supplement the small quantities...divided by 5 days a week - on average)

~$13 per dinner (safeway rotisserie chicken + premade salad - on average)

Total: $25 per day (to be safe)

Total: $400 per paycheck ($25 times about 16 days per paycheck)

In other words, I'll take the average amount I spend per meal and do some quick math to figure out how much I spend every paycheck.

Note: Make sure you enter a negative number, which says that you're yada yada yada.

How much should you spend on basic food needs? I'd recommend no more than 10% of your income after taxes.

Phase 7: Other Expenses

You get the idea at this point. I've listed all the recurring expenses that I have on the example budget. You can check your credit/debit card statement for more expenses you might have missed (or wherever there's a record of what you pay for things).

Calculate your expenses per paycheck and add them into your budget on each line. Remember to divide monthly expenses by 2.

Feel free to add or remove lines as you see fit. Make sure you include everything that you pay every month.

Some specific notes from my example:

- Technology

- For me, this includes github, paying for domain names for the websites I run (namecheap and hover), and some productivity tools (boomerang is great).

- If you bought a computer or phone or something that cost a lot of money up front, you can consider spreading out the cost and putting it here.

- To keep it simple for now, don't worry about computers/phone/expensive equipment. We'll assume that the money for these big purchases comes out of savings and disposable income.

- Health/Doctor

- I assume that I'll get injured at some point during the year and will have to go to the doctor. I also have custom orthotic inserts for my feet that cost about $120 per year. $50/month is a ballpark amount that I use to be comfortable

- Student Loans

- Avoid these if you can.

- Transportation

- This includes my commute for my job: $70/month for the bus

- Includes the Lyfting, Caltraining, and BARTing I do outside of my normal commute as well

- My work lets me save on taxes for the bus, but I like to stay conservative and assume I'm paying the full amount.

- If you own a car, add every cost related to it here: gas, insurance, maintenance, etc.

- How much should you spend on Transportation? Aim for 2-8% of your after-tax pay.

Note: Make sure you enter negative numbers, because Beyonce says so.

Phase 8a: Disposable Income - The Holy Grail

You've made it. If you've entered all your expenses correctly, you should see the amount left over at the bottom. This is your money to play with.

In the example, I have $355 left over every month to spend as I wish.

Here are examples of things that I spend my disposable income on: books, fun events, airplane tickets, New York Halal Cart pretzels, paying for friends' dinners, paying for lyft instead of taking the bus when I want to get somewhere faster, tennis racquet, a space pen, periscope glasses, clothing, etc.

Do I, personally, spend it all as I wish? No. I generally choose to save more and explore interesting investment opportunities.

If you spend more than your disposable income every month, you're in trouble. And if you don't feel it, your 70-year-old self certainly will.

No more action items here. Move on.

Phase 8b: Disposable Income - Build the Personal Habit

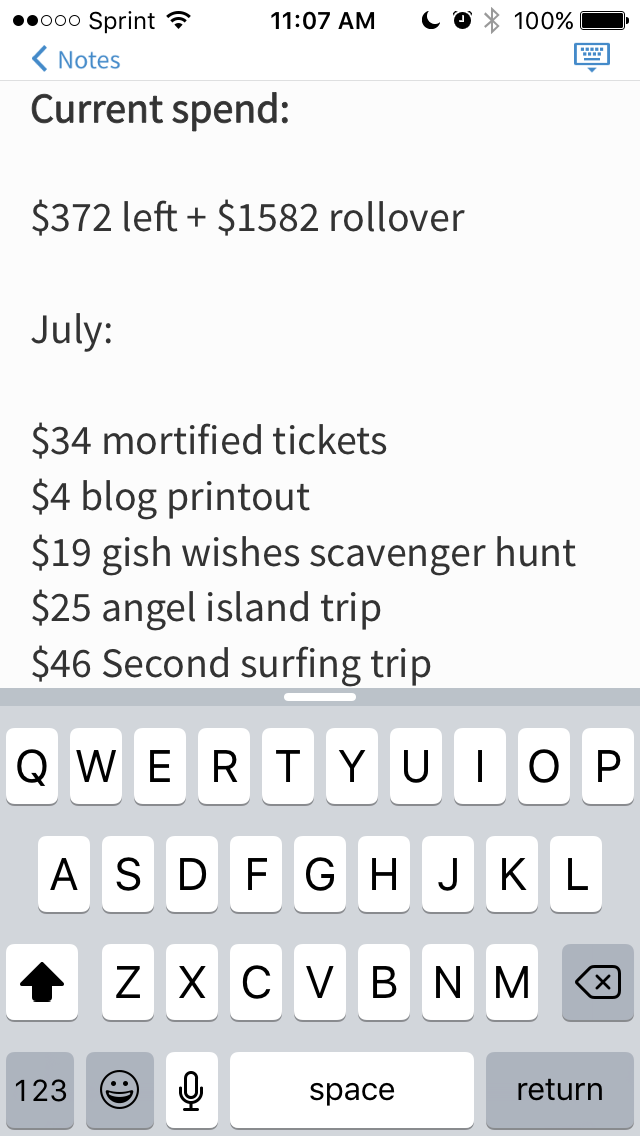

To make sure you're not overspending, start a list of what you spend your disposable income on every time you spend money. Also, keep track of how much disposable income is left. Ideally, you can access this list from your phone or your pocket. I recommmend simplenote, but your native notes app or evernote should work too.

I replenish my total at the start of every month and roll over any money that I don't spend. This lets me get a sense of whether I can afford a new computer, orchestra tickets, first-edition Wu-tang Clan album, or any other big purchase. Sometimes I'll choose to put the rollover into savings.

Here's an example of the simplenote list that I keep. I start with $500 per month and subtract from it each time I add an item:

Remembering to add to this list is going to be the toughest part of this entire project, because it involves building a habit.

A few strategies to build the habit:

- Everytime you buy something, mentally remind yourself to add to the list.

- Difficulty: hard

- Reward: great

- This is what I do. I've built the habit.

- Send yourself an automatic text every morning reminding you to add what you bought the previous day using an app.

- Difficulty: medium

- Reward: medium

- Requires some setup

- You may forget what you bought the day before. You also have to act on the text.

- Put a post-it note on the bathroom mirror to add to your list while you brush your teeth

- Difficulty: medium

- Reward: medium

- You may forget what you bought the day before. You also have one hand on your toothbrush.

- Your Post-it may fall off the mirror.

- Whatever else works for you.

Make your list. Then pick one of these strategies and spend 10 minutes doing as many steps as you can to engineer the habit. Before you move on, double check that you have a system in place.

Phase 9: Keeping Track of your Spending

It used to take a lot of time to keep track of your spending: it sucked to have to look at the tiny details in your credit card and bank statements.

Luckily, this is all automated.

- Go to https://wwws.mint.com and create an account

- Hook up all your accounts: credit cards, banks, loans, etc.

- Go to the "Budgets" section and make a budget using the numbers from your excel sheet.

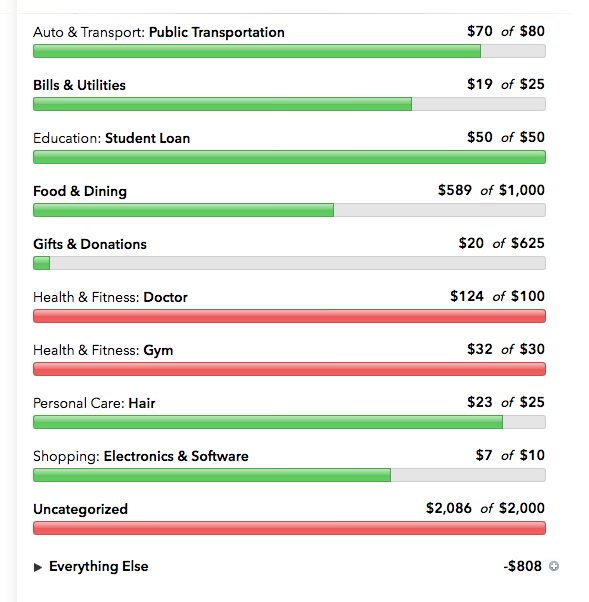

Here's an example of what part of my mint budget page looks like for the month of June. My rent check is part of what mint calls "Uncategorized":

Notice that my green and red bars don't perfectly fill up my budget. There are some expenses that mint finds hard to categorize. Personally, I don't think it's worth my time to categorize these by hand, and I'll just give a quick once-over every month to make sure there are no surprises.

Poke around the Budgets and Transaction tabs. You should get a visceral sense of what you've spent and what you're going to spend.

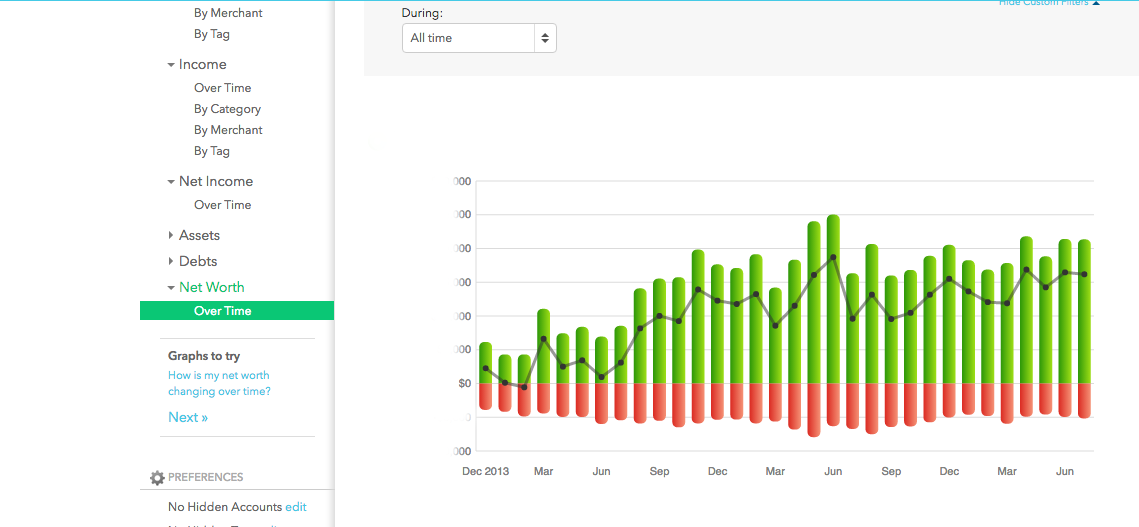

Then poke around the "Trends" tab, and specifically look at your spending over time. If you have enough data, make sure to look at "Net Income" > "Over Time" to see whether you've been spending or saving more every month. "Net Worth" > "Over Time" is also a nice one.

Phase 10: Spending Review - Build the Personal Habit

Schedule a time every month to review your spending. It takes me ten minutes a month. Put a recurring event on your google calendar now with an email reminder. You don't get to do anything else for those ten minutes, even if you're on a plane or vacationing in Jamaica.

During your review, do the following things:

- Look through mint and see if your budget matches up with what you expect

- Go through your credit card statements and look for any unusual spending

- Review your list of what you spent your disposable income on.

- Check that these are the things you want to be spending money on.

- Notice where you want to cut your costs

Conclusion

This is one way to make a budget and it's the system I use to feel comfortable. I have a CPA friend who only reviews his credit card statements to make sure he doesn't spend more than $800 a month. He doesn't make a budget. No excel file or anything else.

His system works for him. This one is more in-depth. Now that you've done an example, feel free to pull out the relevant concepts so that they work for you. Maybe a pencil and paper are more your deal, or maybe you can keep everything in your head (not recommended).

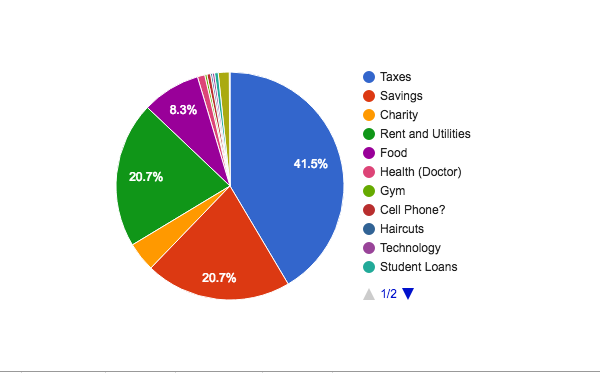

Bonus: See your expenses visually

Want to know how much taxes and rent suck from your paycheck? Here's a chart from the example budget.

Make a chart yourself.