Saving Project

Saving is one of the most important things you can do with your money. If done correctly, the compounding effect will snowball and you'll get peace of mind for the rest of your life.

If you've done the budgeting project, you already put aside some savings (ideally at least 20% of your paycheck) for yourself in the future.

I use the word "savings" here to mean any money you put away for the future that doesn't go towards your immediate expenses. This money will go into savings accounts (they don't really grow) and investment accounts (they grow).

Standard Disclaimer: Everyone's situation is different and what I recommend may not be the best for you. I'm just trying to cover what's generally said to be the best advice as simply as possible. By reading this, you cannot hold me liable for any money you lose or any fury from your descendants.

Now let's see what we can do.

The Goal

The goal is to set up the right accounts for you to save your money. When you get your paycheck, you know exactly the steps to take to save from it.

After this project, you should be able to answer the following questions:

- Where should I be saving my money?

- What websites, companies, and accounts should I be using to save my money?

Setup

You need a computer, internet, and a phone.

Great. You're probably reading this on the internet already. And on the phone if you're a millenial. Gold star for you.

It's also helpful to have some money in a checking account that you're ready to save. This will let you actually open the accounts in this project, but you can do most of the exercises without putting any money in immediately.

Phase 1: Obliterate credit card debt

Credit card debt is really, really bad. It's probably the most expensive debt you have. You can read more about why here. Let's check to see if you have it.

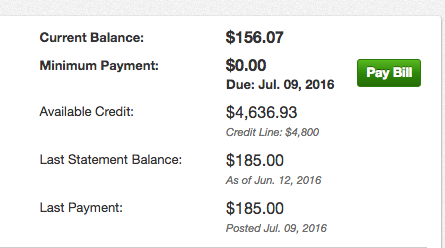

Head to your credit card's website and look at your account. Here's a summary of an account I have with Capital One. The numbers are a bit low because it's not my main credit card, but they have a clean statement that's easy to read.

See how the "Last Payment" is the same as the "Last Statement Balance"? That's what you want. If "Last Payment" is anything less than "Last Statement Balance", you have to pay interest (extra money) on the difference. And that difference grows very quickly over time.

If you see that you owe interest on your credit card, pay off your credit card first before you throw money into anything else. Start paying off your credit card right now. Keep doing this every month until you're debt-free.

The next step: set it up so that you pay your full balance automatically.

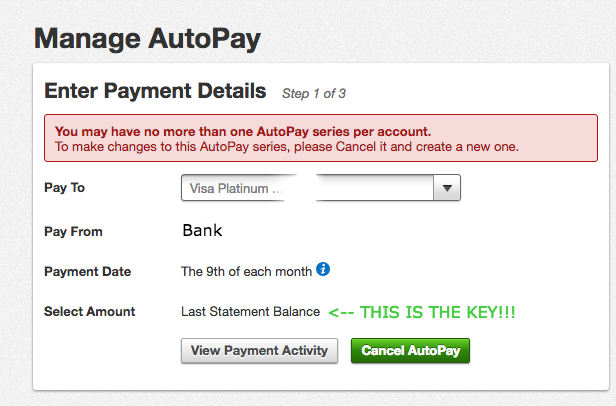

Your credit card should have an Autopay page or something similar. Here's what mine looks like:

The key is checking that box that says "Pay Statement Balance" or "Full Amount Due" or something similar. Do NOT check "Minimum Payment" or "Pay minimum amount" if you can avoid it--that's where the death spiral starts. Speaking on behalf of your great-great-grandchildren, thank you.

Set up your credit card to automatically pay your balance in full, now.

Phase 2: Open a Savings Account

Before you start investing your money, you need to set aside money for when things go wrong.

Start out by saving 6 to 12 months of expenses. Shit happens. If you lose a job, or have a major unexpected cost (e.g., car accident, medical treatment, Ebay auction for french fry that looks like Jennifer Lawrence), you want to have a rainy day account that's easy to access in times of trouble.

How much, in dollars, is 6 to 12 months of expenses? Luckily, you know exactly how much it is because you made a budget in the first chapter.

Add up all the monthly expenses you have from your budget and multiply by 6 (months) to get your baseline number. Don't include savings or taxes--we'll assume you lost your job. Write this number down on a sheet of paper.

Where do you actually stick this money? I use a savings account. My money sits in it in case I ever need it.

What's a savings account? A savings account is a special type of bank account that you can only take money out of a few times a year. You also can't write checks from it or use a debit card with it. It tends to earn you slightly more interest (grows slightly faster) than a checking account. You can take money out of a checking account whenever you want.

What savings account earns me the best interest? What kind of savings account should I choose? Honestly, savings accounts don't earn you much. No matter what kind of account you look at, you're gonna get bupkis (nothing) in interest. The most important thing you can do is avoid accounts that end up costing you money in fees. If you ever hear of "sweep" accounts or "money market" accounts, be wary: the fees they charge tend to outweigh the interest you earn. You'll be fine with the standard savings account your bank has. We'll focus on earning you more with your money later on, once you've established your savings account. The key here is that you want to be able to get to your savings money quickly (within a day or two) if there's an emergency.

I set up my savings account by walking into my bank one day and asking to open a savings account. If you tell a bank teller something like "I would like to open a savings account", they should know what to do.

If you ever need to spend the money in your savings account, you call up your bank and ask them to transfer it to your checking account. I'm able to transfer online.

Here's what I see when I go to my bank website (numbers changed to protect the innocent).

The $3000 in my checking account goes towards paying my normal bills like rent, comcast, gym, etc. The $10,000 in my savings account is gathering dust. And by dust, I mean tiny amounts of interest. I'm not touching this account until an appendage falls off.

Enough blabbering.

Set up a savings account now. Call your bank or schedule a time to go in in-person. Ask them to transfer the dollar amount that you wrote down to your savings account. I have a button on my bank website that says "Make a transfer".

Add a quick check of your savings account to your monthly review. You should be able to check through your bank's website online.

Phase 3a: Max out your 401K at work

If you've completed the steps above and are debt-free, you deserve a firm handshake. You've laid a strong foundation. Feel free to jump on your cousin's uninsured trampoline now: it won't kill you (financially).

If you just started a job or already work at a job, chances are your employer has a 401K plan.

What are 401Ks? Think of a 401K plan as a bank account that grows your money a lot faster than a normal bank account. The twist is that you can't touch that money until you turn 59 1/2. Otherwise you pay a fat penalty.

Where does the name come from? The name "401K" comes from the section of the tax code that sets up these types of accounts.

Free Money

Now the fun part starts. Many companies offer a 401K matching service. Which means that for every dollar you put in, you automatically make two dollars. To put this in perspective: if you put a dollar into the stock market, on average, you'd get $1.08 back in a year, and there's a risk you'll get back less (helloooooo, 2008 recession).

401K matching gives you $2 back, guaranteed.

Some people call 401K matching "free money". If you don't want to put money into your 401K matching plan, I'll lend you some and we can go splitsies on it in a year. Seriously, email me.

If it isn't clear: put as much money into your 401K as your employer will match, at bare minimum. In fact, keep socking more money into your 401K unless you have an obviously better place to put it. You have to stop socking (and start shoe-ing? you'll be able to buy plenty of shoes) once you hit $18,000, according to 2016 limits.

What type of 401K to get: The short version

Even if your company doesn't match your contributions, it's worth putting your money in a 401K for the tax benefits.

What kind should I get?

There are two kinds of 401Ks: Traditional 401Ks (sometimes just called 401Ks) and Roth 401Ks. In Traditional 401Ks, you don't get taxed now, but you get taxed when you take the money out in the future. In Roth 401Ks, you get taxed now when you put the money in, but not when you take the money out.

Rule of thumb: If you're under 35 years old, get a Roth 401K if your employer offers it. If you're over 35 years old, get a Traditional 401K.

Generally, your tax rate rises as you get older, which means you'll get taxed more with a traditional 401K. You're taking money out in the future, when your tax rate is higher. But when you're retired, you might have a low tax rate. You can see how this gets unpredictable pretty quickly. Financial Planners make a living helping you figure out the right details here.

The math can get a little hairy. I've made a bonus reading diving into some details for you if you're curious. If you don't want to think about this much, the rule of thumb will get you pretty far.

Some companies only offer Traditional 401Ks. These are still worth getting, even if you can't get a Roth.

Also, you don't have to memorize all of this stuff; just Google it when you choose between 401K plans (usually when you start a job).

Action Steps

Compose an email to your HR person. It should read something like this (feel free to copy and paste):

"""

Hi Corporate Grunt,

I'd like to increase the amount I'm putting into my 401K. Also, if we have it, can I start putting money into a Roth 401K instead of a traditional 401K?

Let's go with 20% of my paycheck.

Also, we have a company matching program, right? Do you know how much we match?

Thanks! Let me know if there's anything else I need to do.

Best, You

"""

You might be able to change the percentage that you save to your 401K online. I've always had to talk to HR to sign up for a Roth 401K instead of a traditional 401K.

Phase 3b: Picking a portfolio

OK, your HR person sent you a link to set up your 401K. Now you have to pick a portfolio.

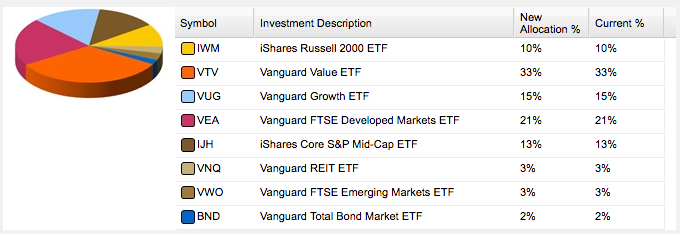

What's a portfolio? It's how you invest the money you're saving. The same way an artist has a portfolio of art projects, you have a portfolio of different investments: stocks that you buy, loans that you make, real estate that you own, etc. In a 401K, someone else will invest in specific securities (stocks, bonds, etc.). You only have to worry about the high-level: choosing what percentage goes to what type of investment. Here's a picture of a portfolio.

We'll go into this more in the investing lesson. For now, assuming you're young, you want to be "riskier" (more money in the long-run, but bigger chance of losing more money in the short-term) and have a really high percentage in stocks compared to bonds. As you get older, you'll become more conservative (political views aside). Financial planners recommend this rule of thumb: take 115, minus your age. That's what % of your portfolio should be in stocks.

In the example portfolio above, you can sort of see that there's some money in bonds--look at the bottom line that says "Vanguard Total Bond Market ETF". Most of the portfolio is in stocks. If you googled the "iShares Russell 2000 ETF" in the top row, the website for it would say you invest in small public U.S. companies, which means stocks.

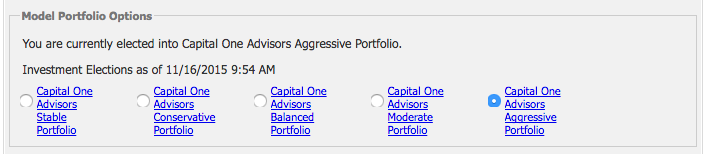

Let's say you're 25. 90% of your portfolio should be in stocks. When choosing your portfolio for a 401K, you'll look for words like "aggressive" and "stocks". Also, don't pick individual stocks: pick a "fund" or "portfolio". Here's what my choice looks like:

Log onto your 401K plan website now and double-check that you've selected the right porfolio.

Send yourself an email in 10 years reminding yourself to look at your allocation again. You can use this site if you want.

Phase 4: Set up and max out your (Roth) IRA

IRAs are like 401Ks, but you can't contribute as much. There's a $5,500 limit in 2016. If you still have money left over, fill an IRA up next.

What does IRA mean? IRA stands for "Individual Retirement Account", which means that you have to set it up yourself and your company isn't involved. You can have both a 401K and an IRA at the same time.

Let's set one up with Vanguard now. Vanguard has very low fees, which is very important (more on this in investing). I like Vanguard for almost everything.

Other good alternatives to Vanguard: Betterment and Wealthfront.

Head to www.vanguard.com and click on the link for "Personal Investors". Click "Open an Account" at the very top.

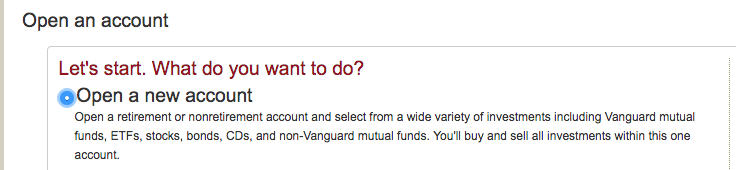

Click "Open a New Account".

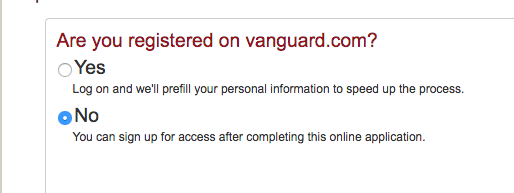

Say you're not registered (unless for some reason you already are).

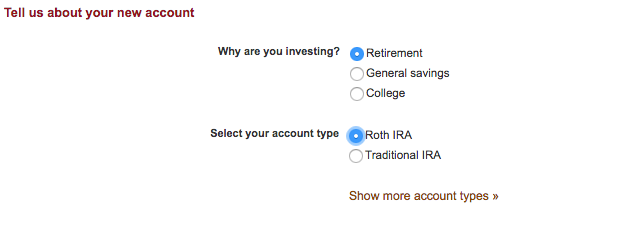

Read the instructions and continue on. Say you're saving for retirement.

The same rule of thumb from 401Ks applies if you don't want to do more research: If you're under 35 years old, get a Roth IRA. If you're over 35 years old, get a Traditional IRA.

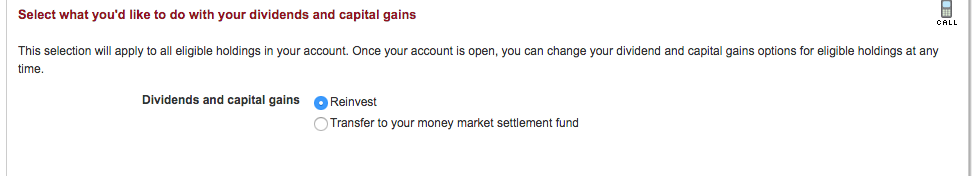

Enter all your information and keep going. If they ask, check the option to reinvest your dividends and capital gains. Otherwise your money will sit and grow slower.

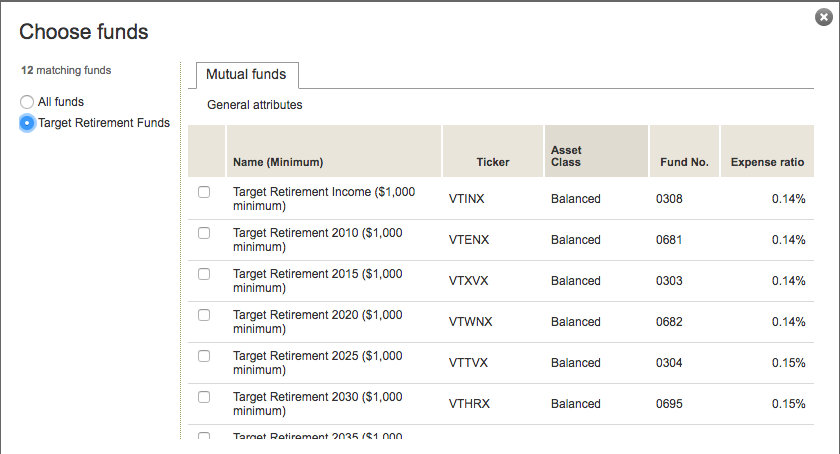

At some point you'll have to pick what you want to invest in. Pick what they're calling a "Vanguard Fund" and select from a list of their funds. These invest in a whole bunch of investments at once (stocks, bonds, commodities) to deal with the risk that any one investment loses a lot of money.

Specifically, choose one of their Target Retirement Funds. These funds automatically change your portfolio to be less risky (to basically have fewer stocks and more bonds) as you get closer to retirement.

Estimate what year you're going to retire and check the box for that fund. For example, if I plan to retire in 2050, I'll choose the "Target Retirement 2050" fund. It's not the end of the world if you're off by 5 to 10 years. You can always switch later.

Put in all the extra savings you have up to the limit.

Add a quick check of your 401K and IRA accounts to your monthly review. You should be able to access them online.

Try not to pay much attention to the red and green % signs when you check: they can be really distracting month-to-month, but history and statstics are in your favor that they will go up steadily over time. Don't pull your money out just because you see red (or green).

Phase 5: Set up a Brokerage Account

STILL have money left over? You must be a bloody Rockefeller. Onward and upward.

There aren't any more retirement accounts that you can contribute to. Instead, you're going to open a brokerage (a "normal") account. There's no special tax treatment on a brokerage account; the government taxes you on any extra money you make from this account, and it has already taxed you on the money you're putting in.

Open up a new account with Vanguard. This time, pick General Savings with an Individual account.

Follow all the instructions and stick your money in the same Target fund there as well. You're such a pro at picking Targets, you should be at archery competitions...I'll see myself out.

How much money should you put in? I like to leave two to three months of expenses in my checking account, then pour anything above that into my brokerage account.

You can put billions of dollars into this account if you want: there's no limit. And if you can put billions in, talk to me. I have some children to marry off.

I think people associate the word "brokerage" with trading specific stocks. You're not doing that here. You're investing in a diversified fund with a buy-and-hold strategy and low fees. More on this in the investing lesson.

If other opportunities pop up, you don't have to put all of your money in a brokerage account. For example, if you want to start a business, or your friend comes to you and says, "hey, we HAVE to invest in some real estate", and you think it's a good idea, you can fund that instead. Whether or not it's the right decision depends on a lot. You can start learning how to frame these decisions in the advanced-investing lesson.

Conclusion

Congrats, you now have a rock solid foundation of savings. If you didn't have enough money to complete all the phases, that's fine. You can revisit this chapter as you start to make more money and need to figure out what to do with it.

As I said before, this advice covers a pretty generic range of people. You might have a special situation that this advice doesn't apply to. Examples might be: you're buying a first home, you have weird unpredictable income, you own a farm, you have college expenses, etc. If that situation involves large amounts of money (say, over $10,000), you might want to consult a professional financial advisor. I've gotten pretty far by googling as well.